Medicare Tax Rate 2025 Caps

Medicare Tax Rate 2025 Caps - Medicare Part A Cost 2025 Clara Demetra, Refer to publication 15 (circular e), employer's tax guide for more information. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Your Guide to 2025 Medicare Part A and Part B BBI, If you have to pay a premium, you’ll pay as much as $505 per month in 2025, depending on how long you or your spouse worked and paid medicare taxes. 2.9% of your untaxed income for the medicare tax.

Medicare Part A Cost 2025 Clara Demetra, Refer to publication 15 (circular e), employer's tax guide for more information. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half.

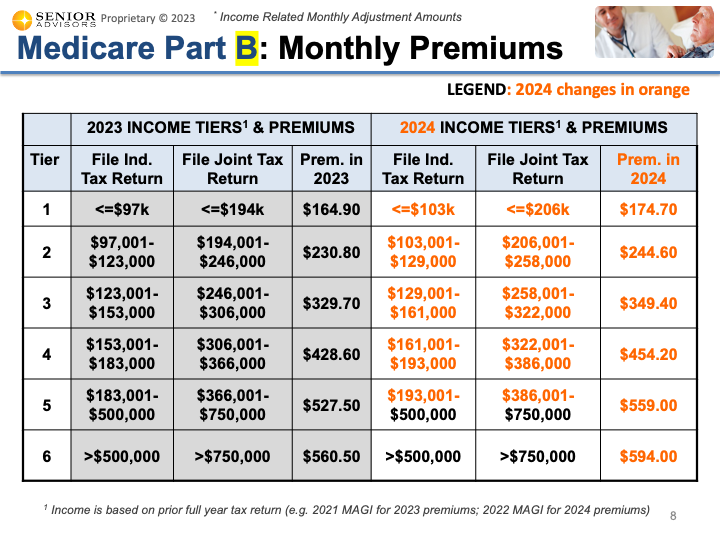

For 2025, beneficiaries whose 2025 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60 to $594.00 depending on.

2025 Medicare Irmaa Costs Roby Vinnie, The medicare tax rate for 2023 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%. May 21st, 2025, 5:09 am pdt.

Part B Irmaa 2025 Limits Tamar Fernande, The information in the following table shows the changes in social security withholding limits from 2023 to. The floor of the rate used to compute the amount due for the additional medicare tax (introduced in 2025) actually depends on an individual's filing status for the federal income tax, but the same floor (listed below) is used for withholding from all individuals regardless of their filing status.

2025 Part D Dona Juliet, Refer to publication 15 (circular e), employer's tax guide for more information. [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare tax.

Medicare Tax Rate 2025 Caps. In 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2023. In 2023, the medicare tax rate is set at 1.45%, which is matched by an additional 1.45% from employers, for a total of 2.9%.

2025 Medicare High Surcharge Glori Kalindi, The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023. The annual deductible for all medicare part b beneficiaries will be $240 in 2025, an increase of $14 from the annual deductible of $226 in 2023.

Medicare Employee Tax Rate 2025 Lani Shanta, The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023.

2025 Medicare NonFacility Reimbursement Rates for Care Management Services, The total medicare tax rate in 2025 is 2.9%. Stocks brace for nvidia's numbers on wednesday.

2025 Tax Brackets Aarp Medicare Heda Rachel, You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. The current rate for medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Irs New Tax Brackets 2025 Romy Carmina, The fica tax rate, which is the combined social security rate of 6.2 percent and the medicare rate of 1.45 percent, remains 7.65 percent for 2025 (or 8.55 percent for taxable wages paid in excess of the applicable threshold). September 13, 2023 by harry sit in healthcare, taxes 1,106 comments.